Getting My Hsmb Advisory Llc To Work

Getting My Hsmb Advisory Llc To Work

Blog Article

Hsmb Advisory Llc Things To Know Before You Buy

Table of ContentsThe Buzz on Hsmb Advisory LlcHsmb Advisory Llc - The FactsGetting The Hsmb Advisory Llc To WorkAbout Hsmb Advisory Llc

- an insurance business that transfers threat by buying reinsurance. - an adjustment in the interest rate, mortality assumption or booking method or other elements influencing the book calculation of policies in force.

- a professional classification awarded by the American Institute of Residential Property and Casualty Underwriters to persons in the residential property and obligation insurance coverage area that pass a collection of exams in insurance policy, risk management, business economics, financing, administration, audit, and law. Marks should additionally contend the very least three years experience in the insurance business or related field.

- costs anticipated to be incurred about the adjustment and recording of accident and health and wellness, auto clinical and employees' settlement insurance claims. - A sort of liability insurance form that only pays if the both occasion that causes (triggers)the case and the real insurance claim are submitted to the insurance policy firm during the plan term - a method of identifying prices for all candidates within an offered set of attributes such as personal demographic and geographic location.

If the insured falls short to maintain the quantity defined in the stipulation (Normally a minimum of 80%), the insured shares a greater proportion of the loss. In medical insurance coverage a percent of each insurance claim that the insured will birth. - an agreement to receive repayments as the purchaser of an Alternative, Cap or Flooring and to pay as the vendor of a different Option, Cap or Floor.

The Best Guide To Hsmb Advisory Llc

- an investment-grade bond backed by a pool of low-grade financial obligation securities, such as junk bonds, separated right into tranches based on various degrees of credit scores threat. - a sort of mortgage-backed protection (MBS) with different swimming pools of pass-through safety home mortgages which contain varying courses of owners and maturations (tranches) with the benefit of foreseeable cash flow patterns.

- a sign of the earnings of an insurance provider, determined by adding the loss and cost ratios. - date when the company initially came to be obligated for any type of insurance threat via the issuance of plans and/or participating in a reinsurance agreement. Exact same as "effective date" of coverage. Health Insurance St Petersburg, FL. - coverage for car possessed by an organization took part in commerce that shields the insured versus economic loss since of legal responsibility for motor vehicle related injuries, or damages to the residential or commercial property of others brought on by accidents emerging out of the ownership, maintenance, usage, or care-custody & control of an automobile.

- quake building coverage for business endeavors. - an industrial bundle policy for farming published here and ranching threats that consists of both building and obligation coverage. Coverage includes barns, stables, other farm frameworks and farm inland marine, such as mobile devices and livestock. - different flooding insurance coverage sold to industrial endeavors - https://hsmbadvisory.jimdosite.com/.

Hsmb Advisory Llc Can Be Fun For Anyone

- a sort of mortgage-backed safety that is protected by the loan on a commercial residential property. - policy that packages 2 or more insurance coverage protections shielding a venture from different building and liability threat exposures. Regularly includes fire, allied lines, different other protections (e. g., distinction in conditions) and responsibility insurance coverage.

- a score system where common ranking is established and normally adjusted within specific standards for each team on the basis of anticipated utilization by the team's workers. - a five-digit identifying number appointed by NAIC, assigned to all insurance provider filing financial information with NAIC. - plans covering the obligation of specialists, plumbings, electricians, service center, and comparable companies to persons who have sustained physical injury or residential property damage from defective job or procedures finished or deserted by or for the insured, far from the insured's premises.

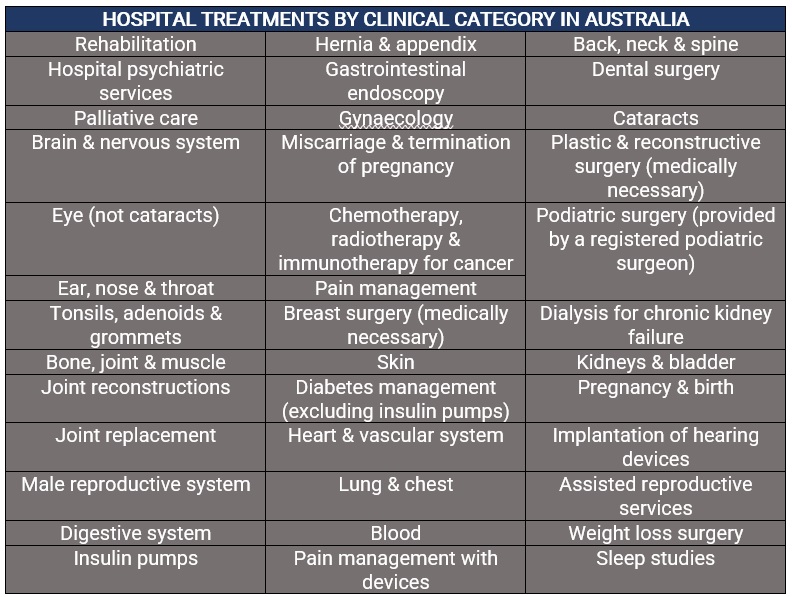

- insurance coverage of all service responsibilities unless particularly left out in the policy agreement. - plans that give fully insured indemnity, HMO, PPO, or Fee for Service insurance coverage for health center, medical, and surgical costs.

Rumored Buzz on Hsmb Advisory Llc

- home loss incurred from two or more dangers in which only one loss is covered however both are paid by the insurance provider as a result of synchronised case. - requirements specified in the insurance agreement that should be maintained by the insured to receive indemnification. - homeowners insurance sold to condominium owners occupying the described home.

- required by some jurisdictions as a bush against negative experience from operations, especially unfavorable case experience. - the liability of a guaranteed to persons that have sustained physical injury or residential property damage from job done by an independent service provider worked with by the guaranteed to perform job that was illegal, inherently dangerous, or straight supervised by the insured - legal or contractual stipulation requiring carriers to provide like an enrollee for some duration following the day of a Health insurance plan Company's insolvency.

- obligation coverage of an insured that has actually thought the lawful obligation of an additional party by created or dental contract - Life Insurance. Consists of a legal liability policy providing coverage for all obligations and obligations sustained by a service agreement copyright under the terms of service agreements released by the service provider.

Report this page